At the heart of our recommendation system is the KDP Default Risk Ranking. This Ranking measures the probability that the company will default on its obligations over a five-year period. In arriving at this measure, the analyst evaluates the company's potential for generating cash flow, its financial strength and overall liquidity, the strength of its products and business plan, and the prospects for overall growth of the industry in which the company operates. As part of this process, the analyst generates a fully integrated financial model including relevant historical results and a minimum three-year financial forecast for the company.

Once the Default Risk Ranking is established, the appropriate recommendation is derived by referring to the yield requirements that KDP has assigned to each Default Risk Ranking. Issue-specific yield requirements for a given Default Risk Ranking are adjusted for maturity, seniority, security, and whether the issue is a discount note or PIK (Paid-in-Kind) bond. If the yield on the bond issue in question falls within the required range, it receives a HOLD recommendation; if it is lower than the range, it becomes a SELL; and if it is higher, a BUY. Our investment horizon is long-term, although we also address near-term technical factors where appropriate and relevant.

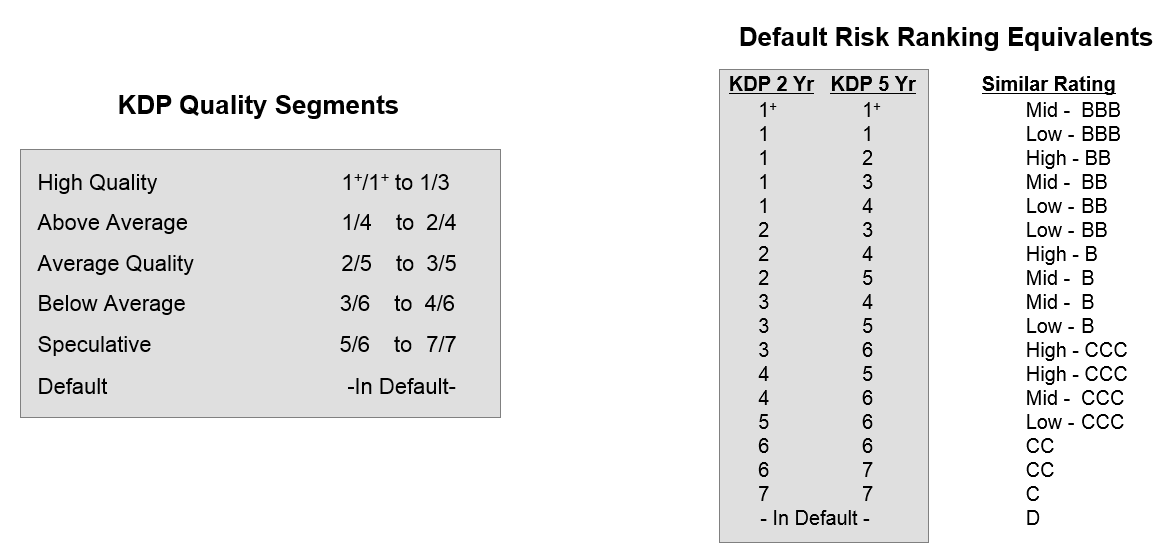

KDP uses yield-to-worst as the total return measure for the bond issues of any company with a KDP Default Risk Ranking of 1+/1+ through 3/5 (Mid-BBB through Low-B). This is due to the relative likelihood that the company will not default on its obligations, and that the full par amount on these issues will be paid, either at maturity or earlier, depending on the issue call schedule and on the probability of early redemption. For the bonds issued by a company with a KDP Default Risk Ranking worse than 3/5 (High-CCC and lower equivalent), the KDP recommendation is tied to an expected value analysis. This change in methodology is necessary due to the higher probability of default and the increased risk that the issue in question will not reach maturity. Generally, our expected value analysis involves calculating the present value of the bond under two scenarios: a going concern scenario and a restructuring scenario. Probabilities are then assigned to each scenario, based on the probability of default implied by the company's Default Risk Ranking. An expected value of the bond is calculated, and this is then compared to the current price to arrive at the proper recommendation.