KDP's coverage of leveraged loans entails providing bank loan information, including a summary of terms and conditions, collateral, covenants and current loan pricing in the secondary market along with fixed rate equivalent yields and spreads. The primary focus is on institutional Term Loan B's with coverage of second lien loans, revolvers and other term loan tranches as deemed appropriate. We assign a proprietary KDP Recovery Ranking (RR) that is independent of our KDP Default Risk Ranking (DRR), after assessing recovery risk along with other relevant factors including current loan pricing, spread and liquidity, refinancing risk and incorporating our DRR.

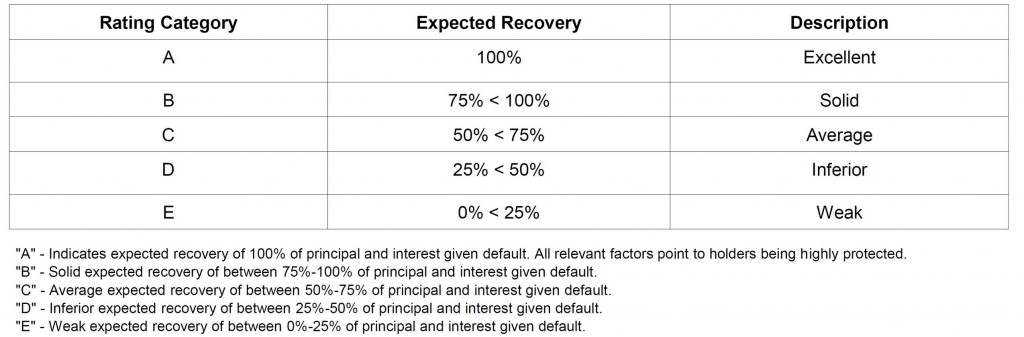

Generally, the KDP Leveraged Loan Recovery Ranking (RR) focuses on risk of loss and is based primarily on our assessment of asset coverage taking into consideration collateral and covenants. Each loan is assigned a letter ranking (A-E) with recovery defined as the undiscounted amount of principal and interest expected to be received in the event of a default and assuming a workout or bankruptcy scenario over a specific period of time (usually 12-24 months). Covenants are important in determining likelihood and timing of default. Strength of collateral is also important in that a strong credit with a weaker collateral package might have similar recovery rating versus a weaker credit with an all assets security package. Expected recovery falls into one of five categories A (highest) through E (lowest). In almost all cases loans held within the KDP Credit Strategy have a Loan Recovery Ranking of A.